Stop drawing random lines. Learn how real traders identify the levels that actually matter.

Introduction: Most Traders Get S/R Completely Wrong

Support & Resistance is one of the most repeated concepts in trading — and one of the least understood.

Most traders:

- draw 10+ lines everywhere

- pull random levels from every timeframe

- treat every small swing as “support”

- get trapped by fake breakouts

- ignore context

- enter just because price “touched a line”

This is not professional trading.

Support & Resistance, when used correctly, gives you:

- clean entries

- clear invalidations

- real trend context

- trap identification

- high-probability continuation or reversal points

This is the professional approach — direct, clean, and context-driven.

What Support & Resistance REALLY Is

Support is where buyers previously dominated.

Resistance is where sellers previously took control.

But the key is this:

- These levels are not lines.

- They are zones, areas where decisions were made.

- Only strong reactions matter.

Support & Resistance is not about touching a line.

It’s about identifying where the market cared.

This requires filtering — not drawing lines everywhere.

The 3 Types of S/R Levels That Actually Matter

Professionals use only these three:

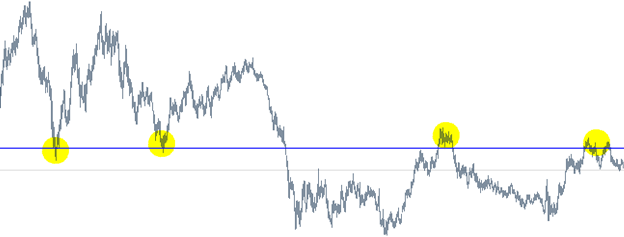

A. Major Swing Highs & Lows (High-Value Levels)

The most important S/R on any chart.

Characteristics:

- strong reaction

- clear rejection

- obvious turning point

- visible on higher timeframes

- used by institutions

These levels create the structure of the market.

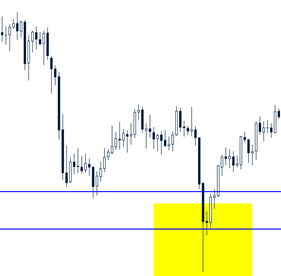

B. Breakout Zones (Former S/R Flipped)

When support breaks → it becomes resistance.

When resistance breaks → it becomes support.

This is where:

- breakout traders enter

- trapped traders panic

- retests give clean entries

This is the foundation of the Breakout–Pullback (BOPB) setup.

C. Liquidity Levels (Wicks, Stop Hunts)

These are underrated and extremely powerful.

Characteristics:

- long wicks

- fast rejections

- fake breakouts

- stop runs

These levels show where traders are trapped — gold LOVES these.

Example: price breaks below support, forms a long upper wick, then closes back inside the zone — that is trapped breakout liquidity.

How to Mark Support & Resistance — The Clean Method

Professionals use a 3-step filter:

Step 1 — Mark only the obvious levels

If you need to zoom in, change timeframe, or squint →

it’s NOT a real level.

If it’s not obvious → ignore it.

Step 2 — Identify the “reaction strength”

Strong reactions = strong level.

Weak reactions = noise.

Ask:

- Did price bounce hard?

- Did momentum shift instantly?

- Did multiple traders get trapped?

This determines the weight of the level.

Step 3 — Draw zones, not lines

Never draw a single horizontal line.

Use zones that cover:

- wick + body area

- where traders reacted

- where volume happened (if available)

A level is an area of interest, not a pixel.

Support & Resistance Are Zones, Not Lines.

Multi-Timeframe Support & Resistance — The Smart Way

Here’s the hierarchy:

- Weekly = major zones

- Daily = high-probability zones

- 4H or 1H = precision entry zones

The mistake:

traders use intraday levels without context.

The correct way:

- Mark weekly major zones

- Mark daily reaction zones

- Use 4H/1H only for execution

- Ignore everything lower unless scalping

This removes 90% of noise and confusion.

How Support & Resistance Behave in Trends

This is where traders get trapped.

In an uptrend:

- resistance breaks

- becomes support

- pullbacks bounce on new structure

- failed breaks trap sellers

Correct behavior:

Buy pullbacks into support.

In a downtrend:

- support breaks

- becomes resistance

- rallies fail at new structure

- failed upside breaks trap buyers

Correct behavior:

Sell rallies into resistance.

Support & Resistance in Ranges — The Trap Zone

Ranges are defined by:

- equal highs

- equal lows

- fake breaks

In a range:

- S/R is extremely active

- false breakouts are common

- mid-range is dangerous

- trend setups fail

Professionals avoid the middle of the range and wait for:

- range high → look for shorts

- range low → look for longs

- breakout → retest → continuation

This is discipline — not prediction.

Breakouts and Failed Breakouts — Where the Real Moves Happen

Breakouts fail more often than they succeed.

Why?

Because:

- retail buys breakouts

- professionals fade them

- liquidity sits above/under the range

- smart money takes the opposite side

A failed breakout at S/R = explosive move.

Signs of a fake breakout:

- big wick

- no follow-through

- reversal bar

- fast rejection

- trap pattern

This is where major reversals begin.

Support & Resistance and Stops — Perfect Alignment

S/R gives clean:

- entries

- stop placements

- profit targets

Rules:

Place stops outside the zone

NOT inside the noise.

Target the next major level

NOT random RR numbers.

If price slices through a level like butter → level is weak

Don’t trade it.